The Head And Shoulders Pattern

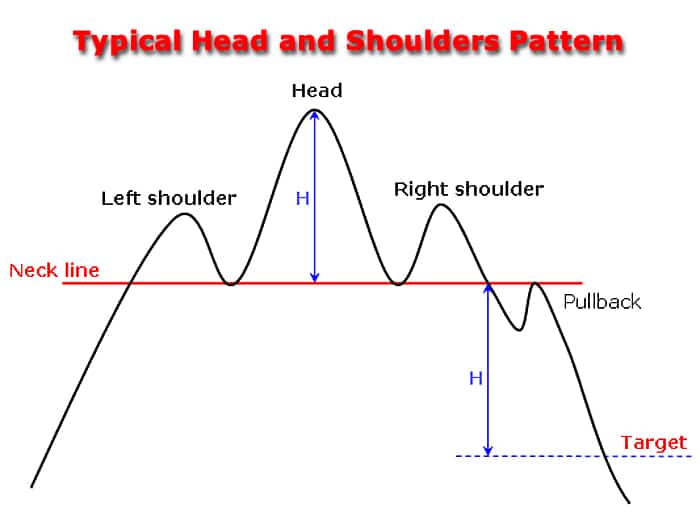

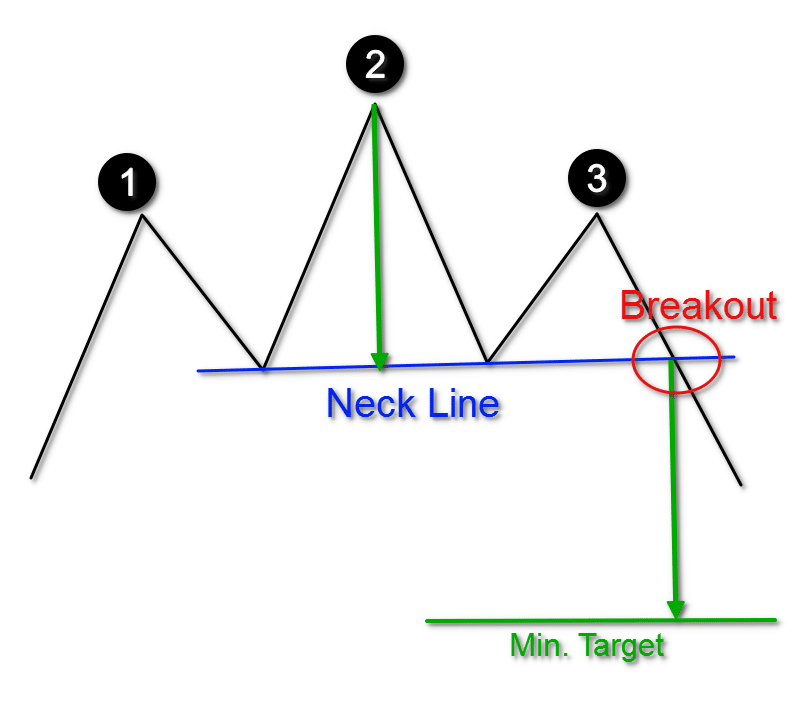

The Head and Shoulders Pattern is a very commonly charted pattern that predicts a bullish-to-bearish trend reversal. Many veteran traders trust this reversal pattern and consider it to be very reliable. The pattern is relatively simple to identify because of its three peaks. The middle peak (the head) is the tallest of the three, the two outside peaks (shoulders) are shorter than the head. The two shoulder peaks should be very close to the same height as each other.

Identifying The Head And Shoulders Pattern

Once again, this pattern can be identified by the first peak representing the first shoulder, a second peak (the tallest) representing the head and the last which is the second shoulder and should be similar height to the first shoulder. A “neckline” can be drawn by connecting the smallest points of the two shoulders. The slope can be either up or down, but when it is down is usually produces a stronger signal for this pattern. Like most patterns, it is very rare to see a “perfect” Head and Shoulders Pattern, make sure your time and use technical analysis to identify common patterns.

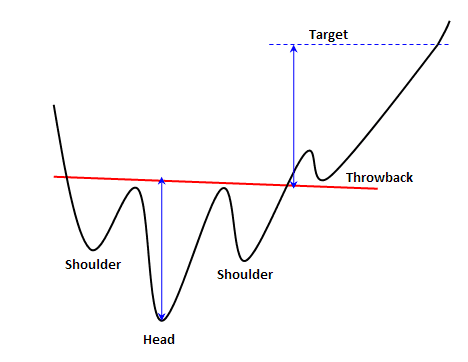

Inverse Head And Shoulders:

The Head and Shoulders Pattern can also be reversed in similar fashion as the Cup and Handle pattern was. In this case three valleys are formed instead of peaks. The lowest valley is the “head” and the two smaller outside valleys are the “shoulders.” This pattern usually happens after an extended period of downward momentum. It is very important to learn both variations of this pattern as they are both equally as powerful.

Drawing The Neckline:

The neckline is an important part of this pattern and we will discuss more later on, but for now it is important to learn how to properly draw this line. First make sure you are using a trading platform that allows for the use of tools, get a new platform if yours doesn't! Next select the line tool and connect the lowest part of the left shoulder to the lowest part of the right shoulder after the head has formed. In a reverse Head and Shoulders Pattern the neckline is placed on the highest point of the shoulders. A neckline that is slightly pointing in the upward direction can indicate a stronger signal than a flat or downward line in the reversed pattern.

What Does The Pattern Mean?

This pattern like most others can occur on all time periods which is why you should be vigilant and patient when making moves. The Head and Shoulders pattern provides a relatively easy way of identifying an entry point, profit target, and stopping points. When a normal pattern is complete and the price drops below the neckline this is a strong indication that the price will continue to go down. On the other hand, in the inverse version of this pattern when the price breaks above the neckline it is a good indication that the price will continue to rise and there are profits to be made.

How To Trade With The Head And Shoulders Pattern

Just like any other pattern, it is very important to be prepared and have practiced identifying key concepts before placing large amounts of money into it. With that being said, the very first rule is to make sure that the pattern has fully completed and factors like volume have been accounted for. If you see a pattern start to form, dont assume that it will complete as expected. Wait for the price to break lower than the neckline after the second shoulder. This is usually a good indication that the pattern has been completed. Keep up an up to date plan on the ever changing price, like entry points, targets and stop losses to maximize your profits and minimize the losses (there will be some).

Most traders prefer to enter a trade when the price breaks above the neckline of a reverse head and shoulders pattern. Just because the neckline has been broken through, it does not necessarily mean that the pattern will continue upwards. Sometimes the price comes back down to the neckline, this could also be a better point to enter but takes more time and patience to complete.

Where To Place a Stop

When the normal pattern has been completed and you have entered the trade, the most common place for a stop loss to be placed is slightly above the top of the right shoulder. The head can also be used as a stopping point for this pattern, be aware that placing the stop here is much riskier and the loss will be greater than the tighter stop loss. If you are trading an inverse pattern, then the stop is commonly placed slightly below the bottom of the right shoulder. Another spot is once again just below the head and it is still riskier and bigger losses may occur. The inverse pattern and normal pattern do not differ from each other, they are just opposite as expected.

Where To Take Profits

Like any pattern it is important to identify a solid and realistic profit target to maximize your efficiency. In the normal pattern the most common profit target is the height between the head and the low point of one of the shoulders. This height is then placed below the neckline, a profit target should be placed at this point. The same works for the inverse pattern, except the height difference is added above the neckline. The shorter you make this line, the less profit you will make but these profits will be more guaranteed. Extending this line will result in greater profits but there is a greater chance that you will end up losing money. Other indicators like the Fibonacci retracement tool can be used to more accurately sell off your profits.

Limitations Of The Head And Shoulders Pattern

If you watch these patterns carefully, the lows and highs of the Head and Shoulder pattern will show you hints on what the pattern might do next. Like any pattern you need to make sure that all the signals are coming together, an incomplete or partial pattern may cause you (the investor) lots of money. This pattern does not work every single time and do not expect it to either. Make sure you know how to use stop losses and keep your emotions in check! With the proper practice and knowledge, the head and shoulders pattern can be a very profitable tool to add to your belt.

Conclusion

Although the Head and Shoulders Pattern can indicate very strong buy periods, to get the best and most accurate information other indicators should be used to maximize profits. You can learn more about these tools in our Academy.

You need to be ready and educated to make the correct move on these patterns. The best way to prepare yourself is to practice. Like any other pattern, the Head and Shoulders Pattern may throw some false signals and end up pulling back. For this reason, as mentioned before, always use calculated stop losses! This is not the only trading technique and it is highly recommended to use various techniques to be a well rounded trader. This space will eat you up if you are a one trick pony.

We hope you enjoyed this analysis of the well known Head and Shoulders Pattern. If you have any questions or concerns feel free to leave a comment down below or contact us. Head over to the homepage for more trading techniques and cryptocurrency topics. We are here to help and educate, have a great day!