Bitcoin Is Born.

The first bitcoin transaction takes place, 10 thousand bitcoin for two large pizzas!

BItcoins price fluctuates wildly, but, it holds strong and continues to gain traction and increased stability through miner adoption of this financial experiment!

Ease of purchase through regular exchanges as well as sales starts to take off and the first steps of adoption for use a currency take place!

Monthly marketplace sales for Coinbase hit over USD $1 million. Prices rise to over $1000 before dropping down and stabilizing at $700 to end the year.

Prices start out the year at $1000 before falling to speculation over the Chinese banning cryptocurrency. Microsoft begins to accept Bitcoin in the Xbox store.

BTC started at a low of around $200 to start the year, positive media started to drive the price up to a year high of $504. Not much growth had occurred, it proved it could stay steady for quite some time.

The coin began by stagnating around $400 before rising to around $600. Demands for blockchain and other factors allowed it to finish the year off strong at $700.

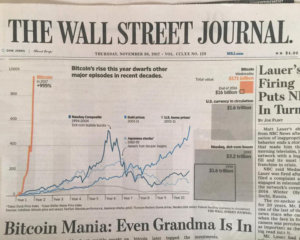

BTC started the year strong at around $1000 and quickly increase to $4,400 with the a large amount of the transactions occurring in the EU, USA and China. The biggest rally occurred and Bitcoin hit all time highs above $20,000. The end of the year brought a pull back to around $13,000.

BTC continues to fall to almost $3000, a surge occurs due to investor confidence and it rises to $9,300 setting the stage for 2019.

As of the writing of this article, the BTC price was $10,114.05, a huge jump from it's opening days. However, there have been some ups and downs in the BTC market this year, with a maximum price reaching $12,367, while the minimum price so far has been $3399.

Only time will tell where Bitcoin will go. Check back here in a few years and its price and news will be cemented into the "history books" of Bitcoin.

Bitcoin Historical Price Snapshot

2009 - Bitcoin is Born

The first days in January (3rd)- Satoshi Nakamoto released the Whitepaper and the new take on decentralized money is born. Peer to Peer cryptographic transfers and distributed ledger technology starts to breach itself into the worldwide web. Known as Proof of work and based around the SHA256 crypto hashing algorithm, there isn't really a way to assign a value to BTC in it's the first year. However, there were several auctions that tried to establish a value in these early days, and the first few trades failed BTC at $50 per 10,000. Regardless of price in its early days, it was adopted by pioneers and those interested in the new technology. Overall, BTC was little more than a research tool at this point in time.

2010 - How much did that pizza cost?!

The year of the first BTC purchase and the first time that any real-world value could be assigned to the coins other than the speculative price in the minds of the creators, which even today still has yet to manifest. While a rather large supply was already circulating, it was in the hands of very few people, most of which whom were mining and keeping track of the ledger. This also the lead to the majority of the BTC millionaires that you see today. The very first crypto exchanges were also opened in this year, allowing the entry of other individuals into the market from the fiat and USD to BTC on ramps that would eventually pave the way for the first waves of adoption

The first price point that can be established for Bitcoins history is based upon the purchase of two pizzas for 10,000 BTC, Now worth hundreds of millions today, it then set their value at a little under a whole cent each. It is worth noting that the majority of transactions during this time were for physical objects, not for other currency, making the value a little harder to confirm and leading to the spiking numbers that can be seen later on in Bitcoin history.

By the end of the month, Bitcoin was worth 8 cents per coin, with the increase being very quickly noted after the first few transactions. Around this time some media reporting on Bitcoin, the first true Bitcoin mining farms, and information about how to mine it came out. This led to a larger market spread and more options for redeeming bitcoin. These early-day use cases for barter added value over time.

2011

Continuing the steady rise from mid 2010, BTC caught up with the US Dollar in February of 2011. This was aided by the opening of a number of marketplaces, the listing of BTC on several international stock exchanges, and international promotion of the currency as a whole. This increase was to continue until it hit it's top point of $31.00 per coin, a point at which many people began rapidly cashing out the market, leading to the first drop. This lack of confidence in the market, the inability to get enough good graphics cards onto the market to meet with demand, and the closing of several major exchanges all helped lead to decreased prices over the next year as well.

In addition, the first theft occurred, with the victim losing almost $400,000, shaking the confidence in existing security measures within the blockchain. By the winter, BTC would fall to a low of $2 per coin, and would see a lowered interest in mining. However, during this time a number of other cryptocurrencies began to be introduced, creating more interest in the original. This would be the driving force between BTC rallying and coming back, leading to the significant growth that can be seen today.

2012

Bitcoin starts out the year low, but begins to rally after it is featured on prime-time dramas and mentioned in most major news broadcasts. This is also the year that the largest theft and the largest block were found in. This meant that much of the news was bittersweet, but that most people could see that BTC had worth and that it was here to stay. This of course led to more investor confidence, which was slightly balanced out by worry and speculation from outside sources.

Starting the year at $2 per coin, it would finish the year at $13 per coin. This slight increase made it something that many people wanted to add to their portfolios and the fact that it could be mined in addition to traded led to the establishment of even more marketplaces and other cryptocurrencies that would try and improve upon or change different parts of the entire blockchain process.

By the end of the year BTC was tradeable under EU regulations, could be used at over 1000 different merchants, and blocks from mining had halved their yield. Increased availability, international viability, and a controlled market that could be seen as actively limiting itself all helped it shoot to the top of most people's investment portfolios.

2013

By the first month of this year, monthly sales for the marketplace Coinbase would hit over USD $1 million, and BTC would be on it's way to a high of $266 in the next three months. This would be followed by a quick lull that was created by deviations in the block chain. For a short period of time there were two versions of the chain, each recording their own transactions as if they were correct. While this was quickly fixed, it shook the confidence of the market and the bubble burst.

In May, the market stabilized at around $125 per coin and quickly climbed up into the $130 range, resulting in a net profit for those who invested at the beginning of the year and held onto their coins. This quick rally and ability to recover was in part due to the handling of the BTC deviations, but also due to the increased interest in BTC from all sectors. Shortly after a quick summer lull was recorded, with prices rising to over $1000, dropping down to $600, and then stabilizing around $700 just in time for the holidays. Much of the variability during this time owed to Chinese and Silk Road bans on the currency. However, after just one month the market proved it was not reliant upon China, and the currency moved forward.

2014

BTC started out strong at a little over $1000 this year, and then fell to almost $340 following speculation over Chinese banning of the digital currency from even banks. While this would eventually prove to false, this combined together with the shutting of MT. Gox led to a large number of people exiting the market and overall negative projections for the currenct.

Throughout the year Microsoft would begin to accept the coins in the XBox shop, Bitpay and other popular companies would be founded, and the coins would trend at around $500-$600, with the market having large spikes from day to day. This year showed the influence of the media and the need for legitimacy in the year world for the survival of BTC. This is the year that many of the current policies that govern coin value, use of the blockchain, and theft protection would be put into place.

2015

Growth this year was hampered by the problems from the year before, the stagnation of technology, and generally a negative view towards the currency. This was the year that the majority of older players either cut their losses, put away their wallets and forgot about them, or moved onto better investment opportunities. Many companies that were previously steering peoples towards BTC with their investments began to steer them away.

The coins started the year at a low of around $200 and it took them until October when tech news for 2016 and a rush or positive media influence would bring the price up to it's high for the year; $504. This would be followed by a slow decline through the end of the year that left the value around $400, but kept BTC as a somewhat safe investment. This year there wasn't much growth overall, but BTC held steady in terms of demand.

2016

The first half of he year the coin stagnated around $400, then rose up to around $600 as the RMB fell against the USD. The coin was helped in this stagnation by restrictions from major networks, rising power prices, the demands of the blockchain on hardware, and a number of other small factors. However, the fact that it held value when currencies were in decline meant that many people who had previously invested in foreign currencies began to move towards a more BTC and other cryptocurrency focused portfolio again. The coin ended the year at around $700.

2017

Starting out the year at around $1000 per coin, the price would quickly rise to around $4,400 with a majority of the transactions coming from within the EU, USA, and China. This becomes important when the price drops quickly in September from over $5000 to under $3000 when China begins to crack down on improper practices within the countries ICO and exchange. However, the market quickly got over this and went on to rally hitting over $30,000 at the highest point.

Then in December, the market dropped to under $13,000 overnight when South Korea announced plans to regulate the market, exchanges, and transactions within the country. Their characterization of the market as dangerous and extremely volatile was helped along by this quick fall and BTC has not recovered to this point as of now. While the majority of these regulations and the closure of exchanges never really happened, the fact that countries can threaten to effectively cripple the blockchain has made it difficult for some investors to have full confidence in the market.

2018

BTC would continue to fall to almost $6000 in the first month, with investors citing their lack of confidence and a continued lack of mining worthy hardware for those looking to expand their farms or for those looking to get into the market from the ground floor. Through February of this year, the price would fall to almost $3000, with a rebound taking several months, leaving the coin hovering around $4000 for much of the first quarter.

BTC suddenly began to surge with an increase in investor confidence, two factor authentication being implemented on most of the major marketplaces, and nearly global acceptance of BTC. While experts predicted a quick bubble and a crash, the coin would continue to grow to a max of $9,300, setting the stage for the coin in 2019.

One thing that most experts note with the coin around this time is that in times of political turmoil and unrest, the decentralized and non-beholden to once country exchange begins to become more popular. This could be considered a major motivator for the continued growth of the coin at this time. In addition, new advancements in graphics cards, memory, and processors have made it much easier to understand and begin farming, even if the blocks are now much less profitable for those who are mining.

2019

As of the writing of this article, the BTC price was $10,114.05, a huge jump from it's opening days. However, there have been some ups and downs in the BTC market this year, with a maximum price reaching $12,367, while the minimum price so far has been $3399. These owe in part to technological advancements such as the new Cryptocurrency Libra which revolutionized the blockchain, and the creation of more in depth security features.

In addition, several companies announced plans to manufacture or sell more hardware for BTC mining, making it easier for others to access. In the Spring of the year, most of the major investors from the first BTC waves came back and began to buy and trade as well, creating a bigger market with bigger margins. Overall the year has been good so far for BTC and there is no reason to believe that the digital currency is approaching another bubble point.

Going Into 2020

Going into 2020 a number of cryptocurrency companies announced plans to phase out old currencies, to consolidate types, and to do more work on the blockchain as an idea. This combined with the fact that the Iranian government and several marketplaces that had previously been against the use of non-real world currency indicated that they were open to and intending to promote the use of cryptocurrency.

Should this prove to be true and demand should be as speculated, the BTC should continue to rise. At current rates, it would not be surprising to see the market tap out at around $20,000 in the next year, with a slight lull as investors move to other markets, and then another increase the year after. Based on historical trends the next 10 years of bitcoin is looking bright.

Disclaimer for The Arcane Bear

If you require any more information or have any questions about our site’s disclaimer, please feel free to contact us at our help desk info@arcanebear.com

Disclaimers for www.arcanebear.com

All the information on this website is published in good faith and for general information purpose only. www.arcanebear.com does not make any warranties about the completeness, reliability and accuracy of this information. Any action you take upon the information you find on this website (www.arcanebear.club), is strictly at your own risk. www.arcanebear.club will not be liable for any losses and/or damages in connection with the use of our website.

The information provided a The Arcane Bear and accompanying material is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs.

The Arcane Bear does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, The Arcane Bear disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. Your use of the information on the website or materials linked from the Web is at your own risk.

From our website, you can visit other websites by following hyperlinks to such external sites. While we strive to provide only quality links to useful and ethical websites, we have no control over the content and nature of these sites. These links to other websites do not imply a recommendation for all the content found on these sites. Site owners and content may change without notice and may occur before we have the opportunity to remove a link which may have gone ‘bad’.

Please be also aware that when you leave our website, other sites may have different privacy policies and terms which are beyond our control. Please be sure to check the Privacy Policies of these sites as well as their “Terms of Service” before engaging in any business or uploading any information.

Consent

By using our website, you hereby consent to our disclaimer and agree to its terms.

Update

Should we update, amend or make any changes to this document, those changes will be prominently posted here.

Thank you, you have no become a part of the development of our new trading space together.

For this, we are extremely Grateful!

Tijo-

The Entire Bear Council

WEBSITE TERMS OF USE

The information on this site is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any cryptocurrency or other transaction.

Cryptocurrency investments are volatile and high risk in nature.

Don't invest more than what you can afford to lose.

We are not paid to do any reviews, but we do take positions in projects that we believe are promising.

Arcane Bear makes no representations, warranties, or assurances as to the accuracy, currency or completeness of the content contained in this website or any sites linked to or from this website.

Terms and Conditions

PLEASE READ THESE TERMS AND CONDITIONS ("TERMS") CAREFULLY BEFORE USING THE SERVICES DESCRIBED HEREIN.

BY UTILIZING THE WEBSITE LOCATED AT www.arcanebear.com ("WEBSITE") AND PRODUCTS THEREIN, YOU ACKNOWLEDGE THAT YOU HAVE READ THESE TERMS AND CONDITIONS AND THAT YOU AGREE TO BE BOUND BY THEM. IF YOU DO NOT AGREE TO ALL OF THE TERMS AND CONDITIONS OF THIS AGREEMENT, YOU ARE NOT AN AUTHORIZED USER OF THESE SERVICES AND YOU SHOULD NOT USE THIS WEBSITE OR ITS PRODUCTS. ARCANE BEAR RESERVES THE RIGHT TO CHANGE, MODIFY, ADD OR REMOVE PORTIONS OF THESE TERMS AT ANY TIME FOR ANY REASON. WE SUGGEST THAT YOU REVIEW THESE TERMS PERIODICALLY FOR CHANGES. SUCH CHANGES SHALL BE EFFECTIVE IMMEDIATELY UPON POSTING. YOU ACKNOWLEDGE THAT BY ACCESSING OUR WEBSITE AFTER WE HAVE POSTED CHANGES TO THESE TERMS, YOU ARE AGREEING TO THE MODIFIED TERMS. THIS DISCLAIMER OR ANY OTHER DOCUMENT, PRODUCED AND SIGNED BY ARCANE BEAR, DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL ANY SHARES OR SECURITIES OR THE PRODUCTS OFFERED THERETO. NONE OF THE INFORMATION OR ANALYSES PRESENTED ARE INTENDED TO FORM THE BASIS FOR ANY INVESTMENT DECISION, AND NO SPECIFIC RECOMMENDATIONS ARE INTENDED, AND ARCANE BEAR SERVICES AND THE WEBSITE ARE NOT, DO NOT OFFER AND SHALL NOT BE CONSTRUED AS INVESTMENT OR FINANCIAL PRODUCTS. ACCORDINGLY, ARCANE BEAR DOES NOT PROVIDE INVESTMENT ADVICE OR COUNSEL OR SOLICITATION FOR INVESTMENT IN ANY CRYPTOCURRENCY AND/OR SECURITY AND SHALL NOT BE CONSTRUED IN THAT WAY. ARCANE BEAR EXPRESSLY DISCLAIMS ANY AND ALL RESPONSIBILITY FOR ANY DIRECT OR CONSEQUENTIAL LOSS OR DAMAGE OF ANY KIND WHATSOEVER ARISING DIRECTLY OR INDIRECTLY FROM: (I) RELIANCE ON ANY INFORMATION PRODUCED BY ARCANE BEAR, (II) ANY ERROR, OMISSION OR INACCURACY IN ANY SUCH INFORMATION OR (III) ANY ACTION RESULTING THEREFROM, (IV) USAGE OR ACQUISITION OF PRODUCTS, AVAILABLE THROUGH THE WEBSITE.

Intellectual Property

Arcane Bear retains all right, title and interest in all of our intellectual property, including inventions, discoveries, processes, marks, methods, compositions, formulae, techniques, information and data, whether or not patentable, copyrightable or protectable in trademark, and any trademarks, copyrights or patents based thereon. You may not use any of our intellectual property for any reason, except with our express, prior, written consent.

All content included on the Website and associated products and services, such as, but not limited to, text, graphics, logos, and images is the property of Arcane Bear and protected by copyright, trademark and other laws that protect intellectual property and proprietary rights. You agree to observe and abide by all copyright and other proprietary notices, legends or other restrictions contained in any such content and will not make any changes thereto.

Access to the Website

The Arcane Bear Website is provided without warranty of any kind, either express or implied. We do not represent that the Website will be available 100% of the time to meet your needs. In case of interruptions we take all reasonable actions to provide you with access to the Website as soon as possible, but there are no guarantees that access will not be interrupted, or that there will be no delays, failures, errors, omissions or loss of transmitted information. We may suspend use of the Website at any time for maintenance.