A Bitcoin Primer

If you'd like to gain a clear understanding of all things bitcoin, the best place to start is by making a distinction between two different concepts that share that name. The first of these is bitcoin-as-token, the individual piece of computer code that can be owned and traded like a virtual IOU. The other is bitcoin-as-protocol, the global network that tracks the individual bitcoins-as-tokens and records their activity in a distributed ledger.

One of the great advantages the bitcoin system offers is that users can pay each other without the need for any central authority, like a payment gateway service or a bank. All of the value in bitcoin is created electronically and the currency is stored the same way. There is no physical token representing a bitcoin the way pieces of paper represent currencies like dollars or euros. Bitcoins are produced using free software, and the production happens all over the world.

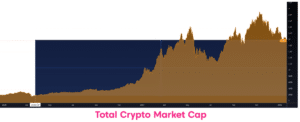

Bitcoin was the first (and remains the most popular) example of a cryptocurrency. Today this class of assets is growing rapidly. Cryptocurrencies share many basic characteristics with traditional currency. As their name suggests, they are all based on cryptographic verification.

Who Created Bitcoin?

A software developer using the pseudonym Satoshi Nakamoto made the first proposal for an electronic payment system rooted in cryptographic mathematics in 2008. Bitcoin was intended from the outset to create an electronic medium of exchange free of any central authority. Payments in bitcoin are designed to be fundamentally secure, verifiable, and unchangeable.

Satoshi Nakamoto's true identity has never been revealed. <<==(BTC WHITE PAPER)

How Is Bitcoin Different From Traditional Currency?

Bitcoin is a functional medium of exchange for electronic transactions. Using bitcoin requires only the acceptance of both parties to the currency. This makes it functionally similar to conventional currencies (e.g. dollars, yen, or euros) which are also used in electronic transactions.

There are key differences that separate bitcoin from fiat currencies, though:

1) Decentralization

Decentralization is the key attribute that sets Bitcoin apart from traditional currencies. There is no central institution that exercises control over the bitcoin system. Bitcoin is run on an open network of dedicated computers all over the globe, and the necessary coding work is done by volunteers. Because of its decentralized nature, bitcoin is especially appealing to individuals and organizations that dislike the way banks and/or governments can control traditional currencies.

One of the most significant challenges facing any electronic currency is the “double spending” problem. What prevents an unscrupulous user from copying and recycling a digital asset? This is why traditional currencies require centralized authorities when they go electronic. Bitcoin meets this challenge with a combination of economic incentives and cryptography. Transaction integrity is maintained across the entire distributed network, with no individual or organization owning the system as a whole.

2) Built-In Scarcity

Traditional fiat currencies backed by governments feature an unlimited supply. Central government banks are free to issue as much currency as they desire. They also can (and do!) manipulate the value of their currency relative to other currencies. The economic burden of these manipulations falls upon the people and institutions who hold it. This system disadvantages ordinary citizens and provides them with few alternatives.

Bitcoin is different because the total supply of the currency is controlled by the mathematical algorithms responsible for the network. Hour by hour, new bitcoins are released as calculations are completed. This process will continue, at a diminishing rate, until the mathematical maximum of 21 million bitcoins is reached. With a fixed supply of assets, growth in demand will produce an increase in value. This makes bitcoin an attractive asset for many potential users.

3) Pseudonymity

Transaction identification in traditional electronic exchanges includes buyer and seller identification. This is required to verify the identities of the parties and to comply with legal requirements. Theoretically, at least, bitcoin offers a more anonymous alternative. Without a central authority validating buyers and sellers, bitcoin holders are free to exchange the currency without identifying themselves. A bitcoin transaction merely checks the distributed transaction record to confirm that the bitcoins being used have a legitimate history placing them in the hands of the buyer and that the buyer has the authority to send the currency. The bitcoin system does not need to check the identity of the sender.

Practically speaking, bitcoin users are identified by the wallet addresses they use for transactions. This does make it possible, with work, to track transactions. Law enforcement agencies have created procedures for identifying bitcoin users this way if they need to.

Exchanges that enable bitcoin transactions also typically have a legal obligation to identify their customers before allowing them to buy or sell. This introduces another point for potential identification and tracking. The transparency of the Bitcoin network makes all transactions publically visible.

These realities make bitcoin an unattractive currency for unethical users, such as criminals, money-launderers, or terrorists.

4) Permanence

Unlike traditional currency transactions, bitcoin transactions cannot be reversed.

It is the absence of a central authority that makes it impossible to order transaction reversals. Once transactions have reached the distributed network (a process that typically takes an hour), they cannot be modified.

In certain situations, this is cause for concern, but the fact that bitcoin transactions are immune to tampering is primarily an advantage.

5) Divisibility

Bitcoin can easily be traded in amounts far smaller than a full bitcoin. The smallest traceably unit is a hundred-millionth of a bitcoin (0.00000001), which is called a satoshi. Current prices place the value of a Satoshi around one per cent of the value of a US cent. Divisibility makes bitcoin suitable (at least in theory) for small-scale microtransactions that traditional currencies cannot handle.

Arcane Conclusion-

This obviously doesn't cover it all, we are working on getting as much education and entertaining content around the blockchain space created. It's not as easy as we had imagined, but the work is deeply satisfying and through thick and thin, it makes sense, we need to promote blockchain and more importantly, the real purpose of decentralization of power. It has long been a problematic history of humans, governance protocols and the like. It has not been an easy task for us to learn to establish civil and moral codes of conduct. We are now at the precipice where we are writing this stuff, basically into the stone of computer code. I have an optimistic outlook, yet we must be ever vigilant that this technology continues down its organic and intentional path of creating a more equal playing field for all of humanity. This acceptance of each other could send us travelling with inner peace and travelling outer space together, in harmony.

I may sound a little optimistic today, if we don't choose to aim for a better world today, no one else will do it for us tomorrow.

Remember to check us back at our homepage. https://arcanebear.com/