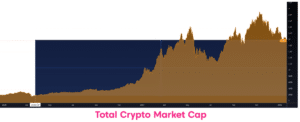

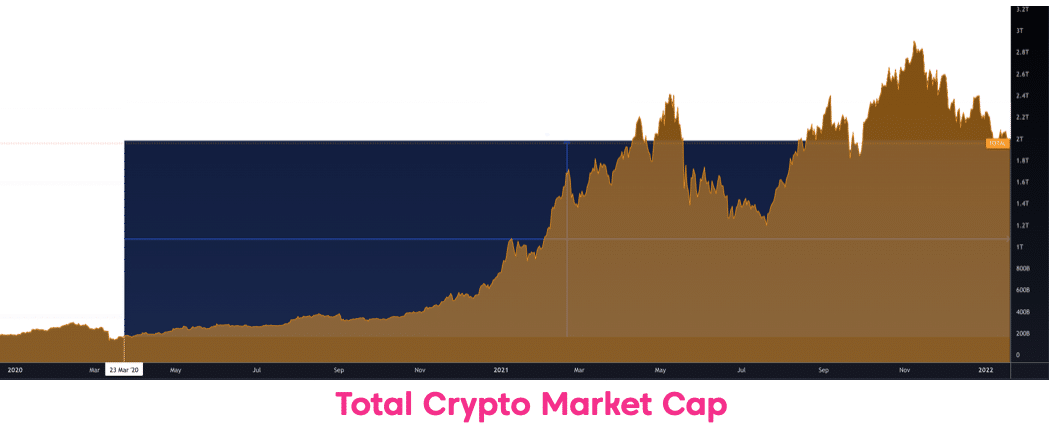

The total crypto market cap grew over 1000% in under two years. How? Why?

Despite the worldwide corporate and retail adoption of digital assets, plus the innovation occurring within the field, our friends at the US Federal Reserve are the primary reason underlying this exponential growth. Their loose monetary policy injected trillions of dollars into the financial system, debasing the currency against which all assets from real estate and luxury watches to food and lumber are measured.

The ruler we use to measure prices is changing; that’s why nearly every asset class has effectively only gone up. Understanding why is critical for investors of all markets. This report covers how we got here and what signals to watch going forward.

Despite the narrative that Bitcoin is an “inflation hedge,” Bitcoin more closely resembled a high-beta (more volatile) stock over the past two years. The price has appreciated hand-in-hand with growth stocks and has dropped alongside those same securities during sell-offs.

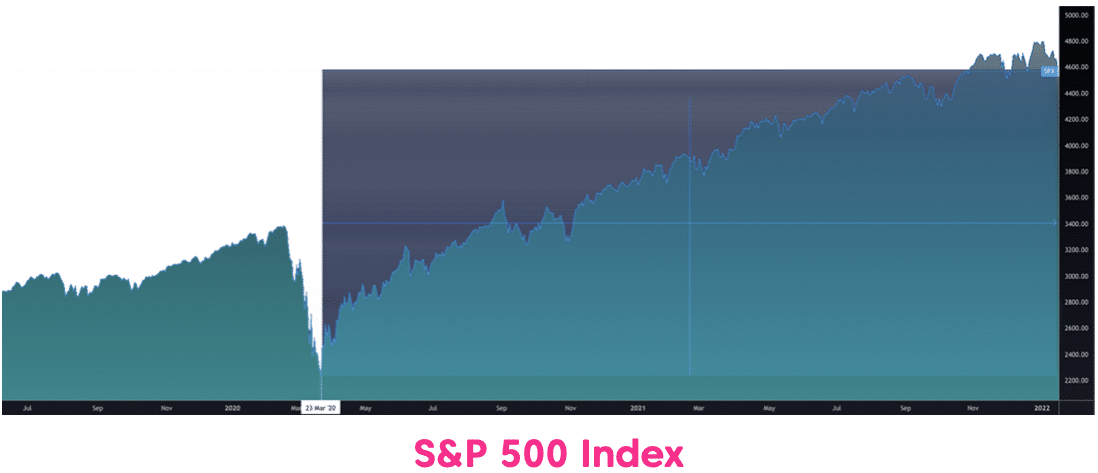

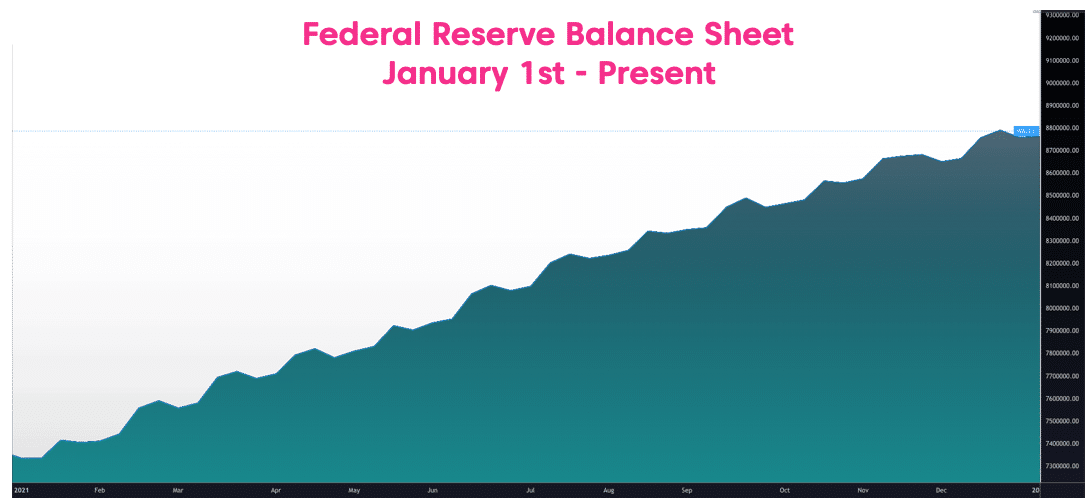

March 23, 2020: The Federal Reserve announces its intention to purchase unlimited amounts of US government bonds and mortgage-backed securities to “support smooth market functioning.” the beginning of this quantitative easing marked the exact bottom for stocks. To date, the S&P 500 has doubled in dollar-denominated value, and the total crypto market cap has added a zero.

Why did quantitative easing impact crypto markets? Well, buying bonds pushes bond yields down, forcing investors to leave bonds in search of higher returns. The combination of low interest rates and an expanding money supply led to a pathetic return of 0.50% on US 10-year government bonds. Investors know they can do better not too much further up the risk ladder.

Their capital moved from government bonds to corporate bonds, but that buying then pushed those yields down too! So, informed investors rotated from corporate bonds to dividend stocks, but that had the same yield-cutting effect, so they moved to growth stocks. This happened on and on and on up the risk ladder.

This process continued until investors stumbled into the highest risk and highest reward arena: crypto. And nearly everyone’s first encounter with our industry is through king corn, Bitcoin.

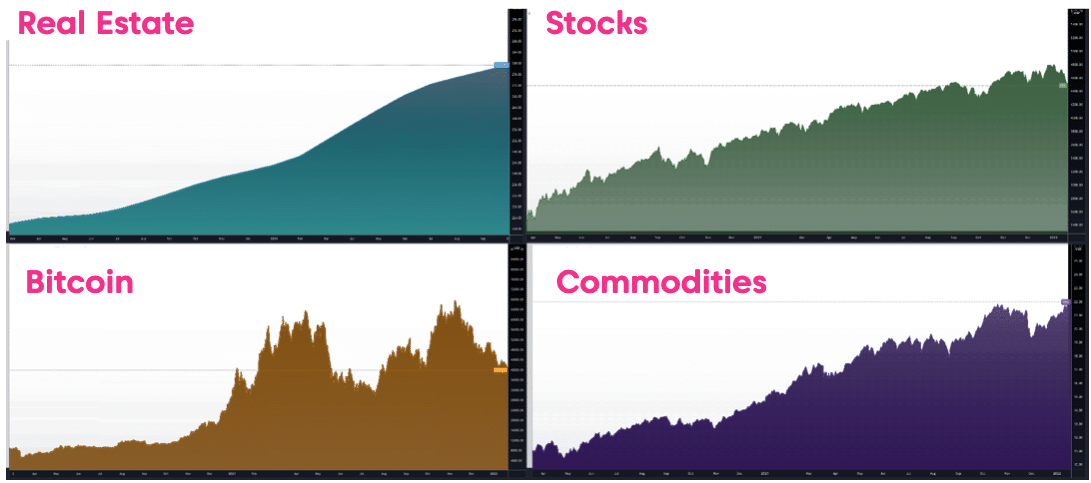

The flow of money from asset class to asset class propped up the prices of all investments, creating an “everything bubble.” Just look at how the four main asset classes have grown since the Federal Reserve started aggressively buying everything, and then look at the growth of the Fed balance sheet. The charts speak for themselves.

This risk-on behaviour is only one reason for Bitcoin's rally. In 2020, how many hundreds of millions of people were stuck at home with government money. The result? More Robinhood accounts - more Redditors’ in Wall Street Bets. Retail investors sliding into a pile of speculative investments, pushing the price of Bitcoin even higher.

The Bitcoin rallies of August 2020 and March 2021 showered confidence across everyone but the most critical of skeptics. Venture capital funds, hedge funds, and family offices began scaling the risk ladder well beyond Bitcoin into all digital assets, including altcoins, digital real estate, and NFTs. This created a massive bubble across the entire digital asset space that is, to date, still deflating.

Is Bitcoin an inflation Hedge?

Many assert that Bitcoin is valuable because it acts as an inflation hedge in an environment of cheap money. After all, there are an infinite number of dollars, but only 21 million bitcoin. This is a common misconception - inflation and currency debasement are two sides of the same economic ruin, but they're not the same thing. Inflation is simply when the prices of goods and services in the economy rise. In contrast, dollar debasement is a currency’s loss of value relative to other assets. Inflation is what the Fed cares about, not dollar debasement. High inflation will force the Fed to raise interest rates, whereas dollar debasement hasn’t stopped since 2008.

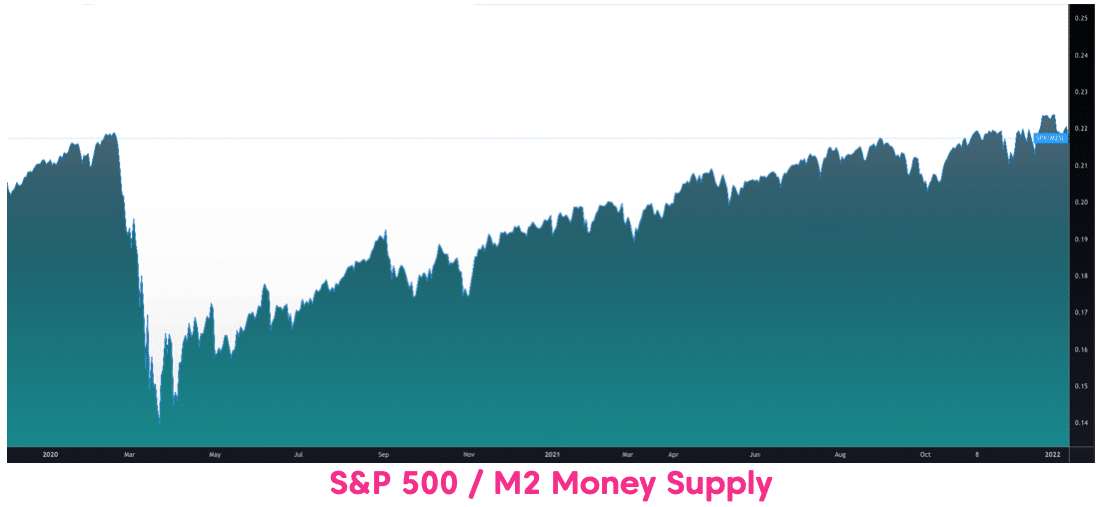

It's shocking how closely the past two years of price action across every market is correlated to the Fed's monetary policy. Viewing the S&P as a ratio to the money supply shows a return to pre-pandemic levels. The chart looks promising, but what's really happened is an injection of artificial demand. The market has become inefficient.

The reality is that Bitcoin trade more like a tech stock than an inflation hedge like gold or silver. Tech stocks have been outperforming the rest of the market. Stores of value have not. Ironically, the record-high inflation print on November 10th actually marked the top for Bitcoin almost exactly, and Bitcoin has fallen 42% since. Despite the "inflation hedge" narrative, inflation may have ironically triggered the next Bitcoin bear market.

Enjoyed this article? It was written by our private bear, @0xZubin. You can find more insight and analysis on crypto and beyond on Twitter: twitter.com/0xZubin.

This is a snippet of our deeper research on what this all means for the present Bitcoin cycle. Joining our sleuth of bears in the Private Bear Den gets you priority access to all our content, VC research, and entry to our private Discord server where you'll find all the technical and psychological info you need to be a wildly successful investor.