Introduction To Ripple - XRP

Ripple provides payment processing programs that handle international money transfers in seconds to businesses and financial institutions. Their programs include xCurrent, xRapid and xVia. The company also owns a majority of XRP, the third-largest cryptocurrency. Its programs utilize the coin to make fast and secure transfers between different fiat currencies. Although we are not a big fan of Ripple, it's mostly centralized and designed to help the banks. The Ripple foundation owns around 61% of the entire liquid supply of XPR, this is dangerous. Although we see that there can be a massive amount of speculation profits from this token in the near future, we are hesitatant to say that we "like" it.

Who Founded the Company?

David Schwartz, co-founder | David Schwartz’s LinkedIn

David Schwartz, Jed McCaleb, Arthur Britto, and Chris Larsen were all part of the original team. David Schwartz came up with the idea for a decentralized, open financial network that could replace SWIFT, the Society for Worldwide Interbank Financial Telecommunication. SWIFT is a network that allows thousands of financial institutions all over the world to send and receive information about financial transactions. Unfortunately, sending payment orders through SWIFT does not allow for very efficient international money transfers – most take at least three days to settle and have pretty high fees. David Schwartz believed he could change this, so he partnered up with Jed McCaleb, the founder of Mt Gox Bitcoin exchange and the eDonkey file-sharing network, to create a new financial infrastructure that could settle cross-border money transfers in seconds without high fees.

Jed and David soon joined forces with another coder, Arthur Britto, to finish XRP’s technical infrastructure.

They also brought on Chris Larsen, co-founder of the online mortgage lender E-Loan, as the company’s first CEO.

Chris Larsen, first CEO | Chris Larsen’s LinkedIn

Check out the links below to learn more about the company and its founders.

Arthur Britto’s Bio on AngelList

How Does It Work?

Ripple users can send money to anyone because of the network’s gateways, chains of trust and digital IOUs. Here’s how it works.

If I wanted to send money to a friend in another country and my gateway (the business that provides me an entry point to RippleNet—this is usually a bank) has a relationship with my friend’s gateway, I can easily send the money. The two institutions that were used as gateways will settle their bill at some point in the near future (a “digital IOU” is recorded in the ledgers so institutions know how much money they owe or are owed) and my money will reach my friend pretty quickly.

Say I wanted to send money to a friend who used a gateway that didn’t have a relationship with my gateway. The network can handle that kind of challenge, too. It will find a “chain of trust” between my gateway and my friend’s gateway. This chain of trust could be just one middleman that has a relationship with both gateways or the money (in the form of those digital IOUs) could change hands a few times before it gets to my friend.

If a chain of trust can’tbe found, that’s where XRP, the company’s native cryptocurrency, comes in. My money will get converted to XRP and then exchanged for the local currency my friend needs.

The cool thing about this system is that it allows you to trade other things besides money as long as somebody in the network wants them. Most commonly that would be valuable assets like gold and silver, but theoretically, you could trade anything.

Software Overview

Ripple has three different payment processing systems that all work together. Banks and corporations that want to use xCurrent and xRapid have to pay fees for the software and implementation plus a very small fee for each transaction.

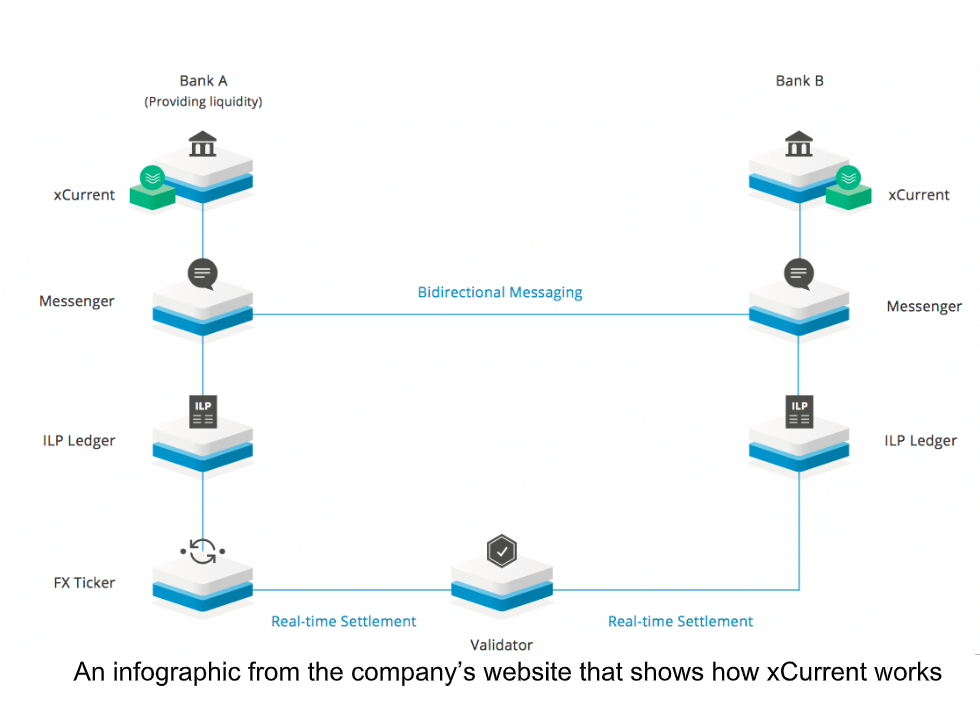

xCurrent is a payment processing system that works with xRapid. It can be used on its own to transfer fiat currencies or in conjunction with xRapid. xCurrent has a variety of features that help facilitate each transaction: a messenger, a validator, the ILP ledger, and the FX ticker.

The messenger feature allows for bidirectional messaging between the banks in the network. They can exchange messages about fees, payment details, and expected delivery times all while knowing that the information is secure.

The validator is a module that cryptographically confirms whether or not a payment has gone through and coordinates the transfer of funds across the ledgers of all transacting parties. I discuss the validation process in more detail later in this post.

The ILP (stands for Interledger Protocol) Ledger is a subledger that can be incorporated into each bank’s current general ledger. It’s used to track liquidity, credit and debit.

The FX ticker is an xCurrent module that allows liquidity providers to post FX rates, which helps with the transfer of funds across borders.

An infographic from the company’s website that shows how xCurrent works.

xRapid attempts to solve the problem of liquidity for international banks. Most large international banks have to keep money in many different local currency accounts for use during money transfers. xRapid gives them the option to free up that capital and use XRP as a “middleman” instead. This is done by exchanging the bank’s primary currency for XRP, and then exchanging it again for the local currency once the transaction is successfully processed. This works because the Ripple network allows for extremely fast transactions. If a bank tried to do this with other cryptocurrencies with slower confirmation times, they’d expose themselves to the volatility of the market and risk losing money.

xVia allows corporations, payment providers, and banks to send money via the same secure network as xCurrent without having to install any of the previously mentioned software. It can be embedded in other software that banks or corporations might already use, like enterprise resource planning software. For that reason, xVia makes it easy and seamless for banks and corporations to make global transactions.

The RPCA

Each transaction in the network is validated by a consensus process called the Ripple Protocol Consensus Algorithm, or RPCA for short. During this process, a majority of the servers, also called nodes, on a list of trusted servers called the Unique Node List (UNL) must agree that a transaction is valid and that there are enough funds available in the sender’s account for it to go through. Every node has its own UNL. Ripple’s server software comes preloaded with a UNL that can either be used as is or customized.

All of the network’s ledgers are open source. There are a few different kinds of ledgers you should know about. The first is the general ledger that shows account balances and transaction histories. The second is the last-closed, which is the ledger that’s been most recently approved by the consensus process. The last type is an open ledger that each node maintains to show which transactions it has initiated. Once the transactions on the open ledger have been successfully processed, it becomes the last-closed ledger. Since they’re all open source, anyone can submit pull requests or even set up their own node to become part of the validation process (as long as they conform to the rules and standards set forth by the company).

Since the network is only semi-permissioned and allows anyone to create a server, the company has put certain security measures in place to prevent malicious nodes from corrupting it. One of these measures is the digital signatures that are used to verify the authenticity of the messages sent between nodes. Because of these digital signatures, the messages are almost impossible to forge.

The company also tries to prevent something known as the “double spend problem.” If a user makes two purchases simultaneously, a network with a decentralized accounting system might be unaware of both purchases. This blind spot would allow a user to attempt to make two purchases even if they only had enough funds in their account to cover one. Both of the purchases might be approved if two different parts of the network are validating each purchase without communicating with each other. To prevent this, a consensus algorithm is applied to RippleNet every few seconds. This updates all the ledgers and makes them aware of every transfer that has been approved.

Nodes in the network will sometimes be deemed “faulty” if they, for example, vote the same way on every transaction, which is another way potentially malicious nodes are disabled before they cause problems. There are also some safety measures incorporated into the consensus algorithm that protect against faulty nodes. Money transfers have to receive a “yes” vote from at least 80% of the servers in the UNL to be approved. If they receive too many “no” votes, they are discarded or voted on again at the beginning of the next consensus process, which is usually only a few seconds away. If 80% of all nodes in the network are not faulty or malicious, then correctness will be maintained, which is demonstrated by the formula shown below.

F equals the number of faulty nodes and N equals the total number of nodes in the network

How Does XRP Differ from BTC?

One of the main differences between these two coins is their speed and efficiency. According to Ripple, their network’s confirmation times are over 1,000 times faster than Bitcoin’s. The former can process 1,500 transactions a second while the latter can only process 7. As a result, users are exposed to a lot less volatility if they use XRP to transfer money globally. It’s also a more energy efficient coin because it isn’t mined like BTC.

XRP also has much lower fees than Bitcoin. The former costs as little as $0.00001 cents to transfer, while the latter costs $3 to $6 on average. That $0.00001 fee isn’t actually paid to anyone—it just gets destroyed. The fee’s main purpose is to prevent spammers, but it has the added benefit of destroying more of the already limited supply of the coin, which in turn makes it more valuable.

The way that the two coins were designed to be used is another one of their main differences. Bitcoin was launched with the aim of creating a new, decentralized financial system that allowed people to transfer money without the help of a third party like a bank. It was mainly meant to be used by individuals for things like purchasing goods and services. XRP was designed to be used by financial institutions, so even though it’s more efficient and cheaper to use, it could never really replace BTC.

One of the only similarities between these coins is that there’s a limited number of each available. Only 21 million bitcoins and 100 billion XRP will ever exist.

How Does It Compare to Other Coins?

Stellar is one of the only companies with its own native cryptocurrency that’s similar to Ripple. Lumens (XLM) is the name of Stellar’s currency. Like XRP, it can be used to transfer money across borders very quickly (each transaction takes only 3 to 5 seconds to be confirmed). Stellar markets its services to a very different audience, though. Instead of targeting large financial institutions, they decided to focus on providing financial services to the unbanked in developing countries. Some areas of underdeveloped countries only have banks that charge high fees, especially for international transactions. Even worse, some banks flat out steal money from their customers. Some people don’t have access to any banks at all. Stellar intends to solve these problems and give people here in the US who send money to family in developing nations an alternative to services like Western Union that charge high fees.

Jed McCaleb co-founded Stellar in 2014, so a lot of people consider it to be a more decentralized, open source fork of Ripple. While Stellar’s first software did start out as a fork, they’ve released new payment systems like Stellar Core that have their own unique code, so calling it a fork isn’t entirely accurate.

Most of Ripple’s other competitors operate permissioned blockchains, but don’t have their own native cryptocurrencies. Some examples of these companies are SWIFT, which CTO Stefan Thomas says is their biggest competition, R3 Corda, Hyperledger Fabric, and the Ethereum Enterprise Alliance.

R3 Cordra uses ledgers and was intended to be used by financial institutions, so it’s probably the most similar to RippleNet out of the three. Hyperledger Fabric and Ethereum weren’t designed for any specific industry, so they have many different applications outside of banking. Check out the chart below for more information about the platforms.

Comparison of Ethereum, Hyperledger Fabric and R3 Cordra (source)

What Are People Saying About It?

Some people believe that the company doesn’t need to have a native assetto be successful because so many of its aforementioned competitors don’t have one. I’ve even seen people online suggest that it will become so worthless to the company in the future that they’ll sell it off cheaply just to get rid of it. While I think that second scenario is highly unlikely, it’s reasonable for people to be skeptical of this crypto even though it has a strong use case. According to the company’s website, about a half a dozen organizations are already using the cryptocurrency in their payment flows: Catalyst Corporate Credit Union, MercuryFX, Cuallix, MoneyGram, IDT, Cambridge Global Payments, Currencies Direct and Viamericas. Dozens more organizations are using the company’s other payment processing program xCurrent. If some of those companies could be convinced to use xRapid as well, the crypto would have an even stronger use case.

A good question that people are asking online is, what incentive do these companies that are using xCurrent have to adopt xRapid? David Schwartz has saidthat transaction fees will end up being the thing that pushes banks to use the coin in their transfers. If the company ensures that the coin is cheaper to use in transfers than fiat currency, banks will use it, which will make the value of the coin go up.

It’s clear that the company believes in the coin and has a big incentive to see it succeed since they hold the majority of it (55 billion coins) in escrow. They’ve also been trying to build an ecosystem around the cryptocurrency for a while, which if successful might help to increase its value. Six months ago, they launched an initiative called Xpringto encourage businesses and entrepreneurs to build on the network and expand the coin’s usage. They got a few big names interested, like Scooter Braun, Justin Bieber’s manager, so this initiative was at least a modest success.

Another concern that people have is that the company has too much control over the network and it isn’t decentralized enough. They don’t like that the company still holds the majority of its native asset and has so much control over who can and can’t use the network. Some people also don’t like that the software comes preloaded with a UNL, because a lot of companies that use it might not bother to change the list. The company’s preferred list of servers could be validating a lot of transactions, which in many people’s eyes gives Ripple too much control over the network.

Ina videoon the company’s YouTube channel, David Schwartz tried to address some of these concerns. He said that all of the network’s code is open source and anyone can build on it. Even if the company disappeared tomorrow, he believes that the network could continue to operate normally. He also touched on the plan that the company has created to release all of the coins it holds into the market. They’re planning to release a billion coins a month for 55 months to provide some supply predictability. Any coins that don’t get used during that month will go back into escrow, adding another month onto the release schedule. All of the information about these monthly releases will be available on a public ledger so that the process is transparent and everyone can stay updated. He also mentioned that one of his big goals for 2018 is improving the decentralization of the network.

Is It a Good Investment?

None of this is finacial advice, and we can personally state, that although we think there are the potential for great speculative gains on these technologies, we are not a fan of the inherent use case to empower banks, which proved in 2008, they are an already failed business plan. The last thing we need to do is give them more power over our lives and bank accounts. So we give this a speculation only look. Not a long term hold fo us as we hope and pray that we replace the centralized systems with once that are aimed at empowering more individuals.

In the most recent market crash that took place around Thanksgiving, this crypto had less of a downturn than major tokens BTC and ether. At one point, it even claimed the second spot, overtaking Ethereum’s position. CNBC host Ran NeuNer urged investors to stop investing in Bitcoinand switch over to XRP in light of the recent steep price drops BTC has experienced. However, THIS WAS A JOKE!

How Can You Get It and Store It?

Occasionally an exchange will let you directly exchange USD for XRP, but most of the time, you’ll have to buy another cryptocurrency like ether using an exchange like Coinbase. Then you can move it over to another exchange like Bitsane or Binance that sells XRP and use your ether to buy it. You’ll need to have a minimum of 20 coins to be able to deposit them in a wallet. You can use desktop, mobile, hardware or paper wallets to store it, just like any other coin.

Conclusion

Ripple has the potential to disrupt the financial industry and displace SWIFT as the main blockchain used to send money around the world. Its speed, energy efficiency, and low fees are almost unparalleled by any other crypto. Hopefully this coin will be utilized by many more banks and businesses so that it will gain in value, and David Schwartz will be successful in further decentralizing the network this year. Those are the only two problems that seem to be keeping this promising coin from becoming more popular and reaching its full potential.

Resources