Introduction & Review To This Stablecoin Protocol

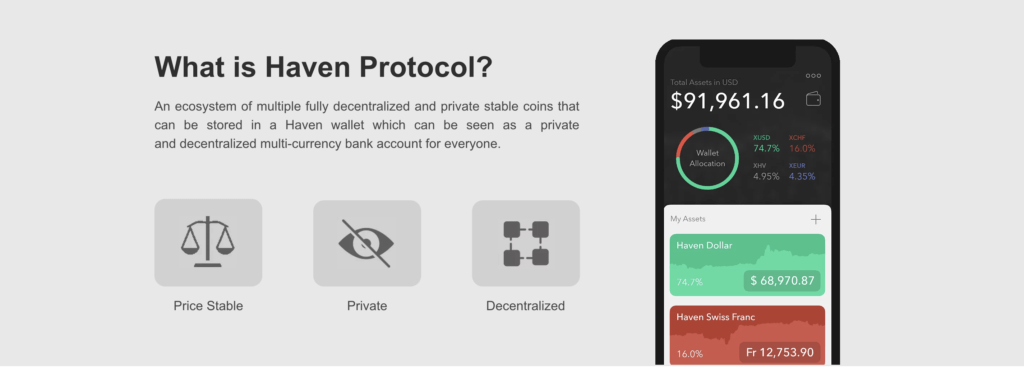

Haven Protocol is a network of decentralized stable coins that can all be stored in a common wallet called the Haven wallet. The team behind Haven Protocol describes it as a “private and decentralized multi-currency bank account for everyone.” Even if you have never bought or traded cryptocurrency before, you should be able to figure out how to use the Haven wallet.

Haven Protocol is a non-profit, open source project that has been built by a team of volunteer developers. The project has been entirely funded by the developers and community donations.

Haven, Haven Protocol’s primary coin, is an untraceable cryptocurrency that offers anonymity and stable value storage to its users. While Haven can be traded at standard market value, the coin’s most unique feature is its offshore storage contracts that preserve its value regardless of market fluctuations.

Haven Protocol uses an updated version of ring signatures called RingCT that obscures information about transactions, keeping each user’s account balance and other sensitive information completely private. Because of all of these exciting features, Haven Protocol does seem to live up to its founders’ claims that using it is like “having a Swiss bank account in your back pocket.”

"In these markets, everyone is saying "hodl hodl hodl" if tokens are going down, you should be out, if things are going up, you should be in! If momentum is against you, the only option now a days is to use an S.C, but nobody really knows what USDT is backed by,if anything. The magic of haven, is that with in your own private keys and your own private waller, you can mitigate these risks of the ups and the downs, so when its going up, yoiu can be in Haven, when its going down you can be in Xhaven, protecting your money, and thats the magic of haven! "

Let’s take a closer look at the features.

Offshore Storage

As mentioned above, Haven Protocol offers offshore storage contracts that lock in the value of your coins even if Haven’s price drops. They do this by “minting and burning” coins. Whenever someone moves their coins to offshore storage, their Haven, also known as XHV, gets burned. Then an equal amount of Haven dollars, also known as XUSD, gets minted to basically serve as a placeholder for the burned XHV. This whole transaction happens in the Haven blockchain, so it’s completely untraceable and user privacy is never compromised.

The amount of Haven that gets returned to you when you take it out of offshore storage depends on what it’s worth in USD at the time.If you decided to store 100 Haven offshore when it was valued at $1 USD and now it’s valued at $2 USD, you’ll only get 50 Haven returned to you if you take it out. Unfortunately, storing Haven offshore will cause you to miss out on any gains you could’ve made if you had bought it and held it instead. Offshore contracts were created to function like an anonymous PayPal account, so they won’t serve as a replacement for your regular investments in cryptocurrency.

As of now, Haven Protocol has two other currencies besides XUSD: XEUR, which represents the Euro, and XCHF, which represents the Swiss Franc. They have five currencies in the works that haven’t been released or publicly announced yet. I have a feeling the new releases will be more coins that represent different country’s currencies to make it easier for people around the world to use Haven.

Money Supply

Haven Protocol has made 18.4 million Haven coins available, but tail emissions and offshore contracts will probably change this number. Once Haven really gets up and running and the currency starts being minted and burned, no one will know what the true number of available coins is. The Haven Protocol team has said that keeping the money supply secret is how they’re going to combat inflation once they start minting coins. The quantity theory of money, which explains how inflation occurs, states that:

MV = PT

M = Money supply

V = Velocity of money

P = Average price level

T = Volume of transactions

According to this theory, an increase in the money supply should increase the price level, creating inflation. But because Haven’s money supply is unknown, it can’t be valued based on its total supply, so it probably won’t be susceptible to very much inflation.

RingCT

RingCT is basically an updated version of ring signatures. A ring signature is a type of cryptographic digital signature that was created in 2001 as a way to hide the identities of people leaking government secrets. Ring signatures have been adopted by cryptocurrencies like CryptoNote to protect the privacy of the people making transactions. RingCT, which was first implemented by Bitcoin Core and Monero, expands upon the idea of ring signatures by obfuscating not only the identity of the sender, but also the transaction amount. Haven is a fork of Monero, so they’ve inherited privacy features like RingCT and stealth addresses from that cryptocurrency.

Mining and Trading

Luckily, buying Haven isn’t the only way to get it. You can mine Haven using any of the pools listed on Haven Protocol’s website. Haven also plans to offer tail emissions to miners. Haven can currently be traded on three exchanges: Bittrex, Upbit, and TradeOgre.

How Does Haven Compare to Other Stablecoins?

Stablecoins are usually divided into three categories: fiat-collateralized, crypto-collateralized, and non-collateralized.

Fiat-collateralized stablecoins or (S.C for our purposes here) are backed by an equal amount of USD or another fiat currency. Fiat currency is deposited into a bank as collateral, and the coins are issued 1:1 against it. Tether is the most popular example of a fiat-collateralized cryptocurrency and is possibly the most popular on the market. However, there’s been some questions about whether or not all Tether coins really are pegged to USD. There are more than a billion Tether coins, and many people find it hard to believe that the Tether team has over a billion USD sitting in a bank account. Tether has refused to publicly share proof of its bank account balances. Maybe that’s why the Haven team called pegs “unsustainable” in their whitepaper and chose not to peg Haven to any currency.

Crypto-collateralized S.C are backed by cryptocurrency instead of being backed by a fiat currency. The crypto that backs these stablecoins usually comes in the form of a bond, which is held in a smart contract. This model allows everyone to see how much collateral is backing the platform because it’s decentralized. Crypto-collateralized stablecoins usually have two coins in their networks: a bond coin that backs the S.C and a S.C that’s associated with a fiat value. Some examples of crypto-collateralized are Havven and Maker.

Non-collateralized are also called “faith-based” . As long as people trust that these currencies have value, they don’t need to be pegged to another currency or backed by assets. It sounds like a radical concept, but this is actually the way that most money, including the USD, works. Some examples of non-collateralized are Basecoin and Carbon.

As you can see, the Haven Protocol team drew inspiration from multiple S.C models when they were building Haven. Haven’s offshore storage contracts and dual coin blockchain are similar to the smart contracts and two-coin model that crypto-collateralized S.C use. Unlike collateralized S.C, though, Haven’s currencies aren’t pegged to anything. It seems like the Haven Protocol team managed to blend the best aspects of collateralized and non-collateralized coins together.

Is Haven Better than Bitcoin?

Haven Protocol’s whitepaper begins with a few criticisms of Bitcoin that it hopes to fix with its coin. The Haven team thinks that Bitcoin’s fees are too expensive, its transaction times are too long, and its protocol is flawed, especially where anonymity is concerned.

Haven does seem to do a few things better than Bitcoin.

The stability of Haven makes it a better option for business owners. When businesses accept Bitcoin, they risk losing money because of how much its value fluctuates. On top of not being as volatile as other cryptocurrencies, Haven has stable storage options and privacy features that could make it really attractive to business owners who want to accept cryptocurrency without risking their profits. Haven is also a more attractive option than Bitcoin for people who want to store large sums of money outside of the traditional banking system because it’s not nearly as volatile.

Bitcoin has been criticized for not planning to offer any incentive to miners after all of the blocks have been mined. Miners help process transactions and secure the network, so that decision could have a lot of negative consequences for Bitcoin. Haven Protocol, on the other hand, has decided to offer miners tail emissions, so they won’t have any problems once all of their blocks are mined.

Bitcoin has some advantages of its own, though, and Haven has some potential drawbacks.

Bitcoin has a much higher trading volume than Haven, which makes it much less vulnerable to pump and dump schemes, which are discussed more later in this article. It would be impossible to acquire 25% of Bitcoin’s trading volume to try to dictate its price, but that’s something that could possibly be done with a smaller cryptocurrency like Haven.

Bitcoin doesn’t offer as much privacy as some of the altcoins that are popping up, and because of that, the number of Bitcoin transactions associated with illegal activity seem to be going down. Haven’s whole brand is centered around privacy and anonymity, so it could potentially attract people who are doing some unscrupulous business. A former Silk Road vendor reviewed the coin recently, giving it a positive rating.

Who Is the Team Behind Haven?

No one knows exactly who is behind Haven. All of the developers and team members used avatars in their profiles instead of real headshots, and chose to use pseudonyms like “Haven Dev” and “Donjor” instead of their real names.

Hiding the identities of the team members is an interesting decision. It certainly fits in with the Haven Protocol brand, which emphasizes privacy and security and comes across as pretty edgy. Could the team’s choice to conceal all of their identities decrease people’s trust in the cryptocurrency? Possibly. This decision makes the company seem less transparent, which could hurt its reputation. The Haven team also missed out on an opportunity to prove their authority and expertise in the cryptocurrency niche by revealing their identities, past projects and experience.

Haven Protocol Release Dates

By the end of this quarter, the Haven Protocol team says offshore storage and bulletproofs integration, which will decrease transaction cost and chain size, will be released. To ensure a successful launch of offshore storage, the Haven team is also reaching out to other developers during this quarter to have them review the code. In quarter one of next year, Haven Protocol’s (S.C) XUSD will be made available for trading. Eight new (S.C), including XEUR and XCHF, will also be added to the Haven Protocol network during Q1 and be made available for trading. In quarter two of next year, the Haven Protocol team will make their last planned release: a redesigned version of the Haven wallet for mobile and desktop that will improve user experience.

What are People Saying About Haven?

Most of what’s being said online about Haven right now is positive.

Some people think that Haven will be popular because it fills a gap in the cryptocurrency market. Many people don’t trust stablecoins like Tether that are pegged to USD, so a truly decentralized S.C like Haven could gain a lot of traction and customers. Many people also like the offshore storage contracts and the possibility Haven opens up for businesses to accept cryptocurrency.

One negative review cited some technical issues that Haven had when it was made available on the Nanex exchange, but that’s to be expected for a new startup. Some believe that Haven is being overhyped and won’t be able to maintain a stable value without any kind of backing. What are your thoughts? Leave your comments below!

Conclusion

Haven Protocol is still a new concept that will remain relatively untested until all of its features are released in the next few months. With that said, Haven looks promising because it gives you the choice between trading XHV just like you would any other coin or securing the value of your XHV in a stable offshore contract. Some drawbacks are the lower volume Haven has in comparison to other more established cryptocurrencies like Bitcoin, which makes it more vulnerable to pump and dump schemes, and Haven’s potential to be used for unsavory business transactions. Haven has some very innovative features that could enable business owners to accept cryptocurrency payments for the first time. For that reason, Haven could become popular and help bring cryptocurrency further into the mainstream, or the currency could fail to achieve its full potential. Only time will tell.

Thank you for following along the journey with The Arcane Bear! Return to our homepage https://arcanebear.com